August 29, 2021

The Evolution Of Big Data Analytics Market

The global Big Data market is expected to rise at a CAGR of 30.08% from 2020 to 2023, equating to $77.6B. By 2026, market size is projected to reach $512B. To put that into perspective, in 2019, the global analytics market was worth $49B, double what it was just four years earlier.

Digital transformation in the form of AI, machine learning, and the Internet of Things (IoT) is driving Big Data analytics spending. Executive-level initiatives are resulting in in-depth assessments of current business practices and demands for better, faster, and more complete access to data and related analytics and insights.

The Emergence of Big Data Technology and Analytics

If you look at the history of Big Data and analytics, you’ll find that the seeds were planted well before the 2010-era Big Data craze. In fact, people have been using data to monitor performance and inform strategic decision-making for hundreds of years—often innovating when data sets grow and become harder to manage.

The first recorded statistical data analysis examination comes from John Graunt. In 1660s London, Graunt gathered mortality data to understand how the bubonic plague spread and to create a warning system to protect people from the disease.

In 1881, a US Census Bureau employee named Herman Hollerith invented a tabulating machine based on punch cards to organize and analyze the information collected during the 1880 census—a process that was estimated to take eight years—and cut the workload down to a mere three months.

In 1965, the US developed the first national data center, an early federal cloud computing solution designed to manage government records from one central location. That said, the road to the modern data analytics market dates back to about 1970, just after ARPANET sent the first email from UCLA to Stanford.

Big Data 1.0 grew out of existing database management systems and serves as the foundation of today’s powerful analytics solutions. This stage introduced database queries, storage, data extraction, and reporting tools typically found in traditional Relational Database Management Systems (RDBMS).

In the early 2000s, things changed thanks to the Internet. The expansion of web traffic and clicks introduced a massive influx of data. This new era, Big Data 2.0, introduced information retrieval and extraction, web analytics, social media analytics, and more.

The current era of Big Data (3.0) began around 2010 with the rise of the smartphone, GPS sensors, the cloud, and, more recently, the IoT.

We’ve come a long way in the past ten years. The IoT has moved well beyond fitness trackers and has evolved into a vast ocean of heterogeneous data. Today, organizations can capture data from just about anything—from social media engagement to industrial equipment, GPS sensors, and carbon emissions.

Databases are also evolving beyond the traditional relational model of previous generations into graph databases that connect data points from disparate sources and identify relationships. What’s more, cloud solutions are now the norm, and as organizations continue to generate more and more data, AI is increasingly being used to uncover key insights hidden in CRM platforms, emails, financial data, and the full spectrum of IoT devices.

Key Drivers in the Data Analytics Market

As mentioned up top, the evolution of data analytics is happening at a breakneck pace. According to a survey, the number of companies investing in AI and BDA increased from 27% in 2018 to nearly 34% in 2019. But what’s powering the Big Data analytics growth rate?

The short answer is that we already create a ton of data—and it’s increasing exponentially due to the rise of mobile app usage, location tracking, cloud computing, and the increased adoption of AI solutions and IoT devices. Here’s a quick look at what’s powering the data deluge:

Key Drivers in the Data Analytics Market

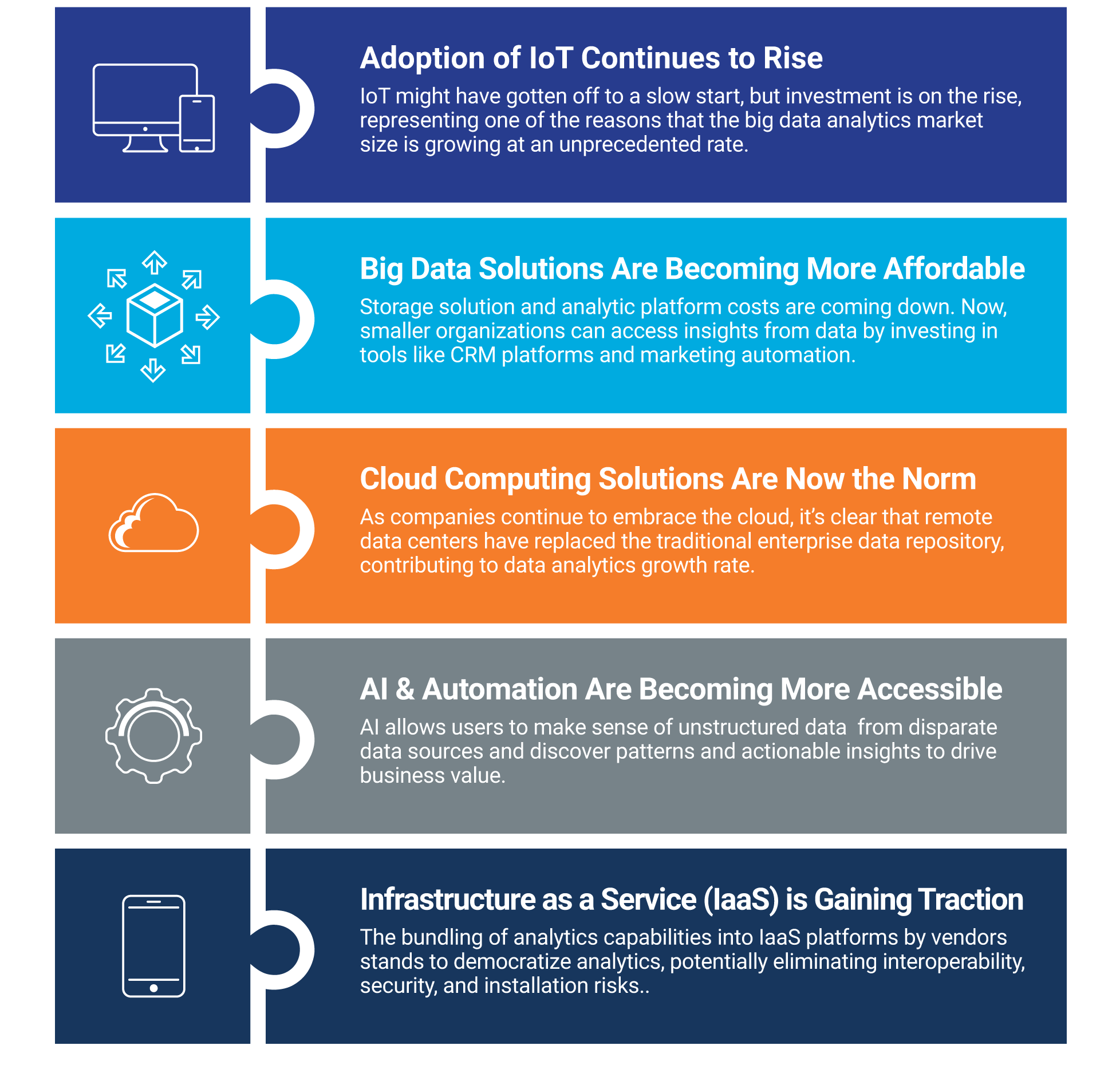

Adoption of IoT Continues to Rise

IoT might have started slowly, but investment is on the rise, representing one of the reasons that the Big Data analytics market size is growing at an unprecedented rate. Recent survey data from the Eclipse Foundation on the Internet of Things found that 40% of respondents plan to increase IoT investment within the next year. A total of 84% of respondents ranked sensors as the most important IoT investment, followed by 77% who said that data processing and analytics were most valuable to their organization.

That said, responses were submitted before the coronavirus outbreak hit, so plans may have changed. The latest in data analytics will soon introduce solutions and data usage patterns as a direct result of the pandemic. Of course, how it all plays out remains to be seen.

Big Data Solutions Becoming More Affordable

As storage solution costs come down, Big Data analytics platforms are also becoming more affordable. For example, smaller organizations can access new insights from their data by investing in tools like CRM platforms and marketing automation software.

Social listening and market research tools allow brands of all sizes to capture and analyze data that helps them spot trends and understand their target audience. And website hosting platforms provide customer interaction and behavioral insights, sales data, and conversion paths that all help businesses make smarter decisions.

Additionally, as adoption continues to rise, organizations are getting wise to the potential cost savings that come from embracing change. As a result, the Big Data analytics market size continues to expand.

Companies can evaluate spending based on more than incoming sales and the cost of raw materials. Big Data analytics allows them to look at the big picture—from annual contracts to production processes and personnel overhead, so that they can identify opportunities to save money or boost profits.

Cloud Computing Solutions Now the Norm

As companies continue to embrace the cloud, it’s clear that remote data centers have replaced the traditional enterprise data repository, contributing to data analytics growth rate. In a 2018 IDC report, the firm predicts that by 2025 nearly half the world’s stored data will reside in public cloud environments.

It’s also worth noting that the COVID-19 pandemic has increased the use of cloud-based platforms as remote work, distance learning, and virtual events have replaced their in-person counterparts. While many companies are cutting costs due to the widespread economic downturn, these at-home solutions represent yet another data stream that needs to be managed.

AI, Robotics and Automation More Accessible

Because of this data explosion, we’re moving toward the next phase in the evolution of data analytics: AI-powered robotics and automation designed to help organizations manage and understand the information they’re sitting on. According to MIT Sloan Management Review, the convergence of Big Data with AI and machine learning (ML) capabilities could be the most critical factor for driving business value from data analytics tools.

And per IDC’s Worldwide Semiannual Big Data & Analytics Spending Guide, researchers expect that cognitive and AI-based software and non-relational analytic data stores will see the most growth in the near-term. AI allows users to make sense of unstructured data from multiple sources that can’t fit into a traditional spreadsheet and identifies patterns and actionable insights from disparate data sources. Additionally, massive data sets make it possible for AI and ML applications to learn quickly and independently.

Infrastructure as a Service (IaaS) Gains Traction

Right now, IaaS is still relatively uncommon. For the uninitiated, IaaS is a sub-type of cloud computing that provides a collection of virtualized resources through the Internet.

In an IaaS model, the infrastructure components typically found in an on-site data center—such as storage, servers, and networking hardware—are hosted by a service provider. That vendor might also offer a range of services to support the infrastructure, including data logging, security, monitoring, load balancing, and backup. Many of these services allow users to implement controls and automation to maintain application availability and optimize performance.

Plus, many service providers are adding data analytic applications and services to users as sort of an all-in-one solution. By bundling these products and services together, IaaS stands to democratize the Big Data analytics market, potentially eliminating interoperability, security, and installation risks common in more complex solutions.

Growth in Data Analytics by Industry

The most familiar examples of Big Data include things like marketing automation software and social media analytics, but the reality is, Big Data is everywhere. Media, professional services, retail, and personal and consumer services have the highest BDA adoption rates.

Many of these companies are digital natives, and embracing change has been relatively seamless. Additionally, e-commerce brands and online publishers don’t face the complex compliance issues or security threats that other sectors have long dealt with.

That said, highly-regulated industries like healthcare, finance, and insurance are ramping up investments out of necessity. Additionally, a lot of growth in data analytics is coming from historically “low-tech” sectors like manufacturing, oil & gas, and public utilities. By one estimate, the manufacturing data analytics market alone is expected to reach $4.55B by 2025, increasing at a CAGR of over 30% between 2020 to 2025.

Growth in Data Analytics Is Here to Stay

The evolution of data analytics has come a long way since the days of the database and continues to expand at a rapid pace. As it stands, we’re seeing many advances in AI, IoT, and IaaS technologies that are powering growth and will likely push us into a new era in Big Data analytics—Big Data 4.0. Businesses will need to master Big Data analytics to keep pace with competitors moving forward.

Data Science and Analytics are an essential craft in creating world-class digital products. Learn how 3Pillar can help you succeed in the digital economy.